This Sunday, my family and I went across the Canada/United States border and went to two malls to take advantage of the reasonably at-par Canadian dollar. While I didn’t have as good luck shopping as on one of our previous visits to the States, I did manage to pick up a few trendy shirts and managed a free lunch out of my parents. I will say this: even as the US economy sags, the ridiculous number of Ontario residents coming down to purchase anything and everything under the sun should at least be a noteworthy economic point of interest.

The big question for Canadian shoppers enticed by the lucrative currency conversion rates on xe.com, though, is what happens at the border. At present, my family generally goes to the States about twice per year. We’re pretty well aware of the personal limits for merchandise, especially since the tariffs for alcohol make any bottle cost the same as at the LCBO.

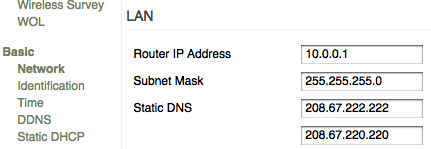

Here’s what the simplified, general rules for cross-border purchases are: if you’re in the United States for less than 24 hours, you get zero personal allowance for personal items, tobacco or alcohol. Legally, upon re-entering Canada after being in the US for less than a day, you must pay duty on everything you’ve purchased. Duty rates suppoosedly vary based on the item, but if you’re willing to read up on them, they can be more expensive than one might think. I noticed rates from 2.5% (on some specialty electronics) to 18% on various types of shoes. Shoe fetishists – be warned.

More than 24 hours away from Canada gives an exemption of $50 per person, even for individuals under 18 years of age – but no tobacco or alcohol is included in this amount. After 48 hours, the limit jumps to $400 and you’re allowed a minimal amount of alcohol – which amounts to one 40 oz. bottle per adult and 200 cigarettes. Seven days or more gives a minimal increase to $750 per person. The Canadian Border Services Agency site gives more details on these exemptions.

While it might seem obsessive to mention these restrictions in detail, it’s interesting for two reasons: how is one supposed get away with shopping in the States for a day, not paying any duty and an object lesson in what happens if you get caught lying.

To set the stage, we waited approximately two hours in line to even approach the customs booths. During this time, we needed to move over one lane to get directly into the cutoff for Canada. In complete gridlock, my dad managed to signal and tried to move over in front of a Yaris. The driver had left enough space in front, and was far over to the left side of the lane as if he had spatial positioning problems.

Things were going fine until Mr. Yaris woke up, decided he didn’t want our car to move in front of him, and promptly honked and reclaimed the remaining space in the lane in a move worthy of appearing on Canada’s Worst Driver. We settled for the next spot in line behind him, and during the next hour or so waiting, the driver of the Yaris unconsciously let in three more cars by leaving more than enough for a merging maneuver. Each time this happened and he woke up, he promptly honked and tailgated the vehicle that had dared to enter the lane. The popular family consensus was to call the Yaris driver “Mr. Jeepers”, although my preferred nickname was “Chuckles”.

As an idiot driver, Chuckles wasn’t too out of the ordinary: you’d generally see this type of person hanging out too far in the opposite lane when turning left. During this time, though, we were debating on the best course of action to take at customs. With the level of traffic at the bridge crossing, it initially seemed better to not declare anything and hope the agent waved us through. After all, it was entirely possible that we’d just been at Niagara Falls, NY for the afternoon doing touristy activities. What’s more, literally thousands of people were doing the exact same thing we’d done the same afternoon. How were they approaching things?

When we approached the customs entrance, however, we selected what perhaps might have been the slowest line to use. Vehicles on our right in the bilingual line were spending no more than ten seconds with the officer before pulling away. Unfortunately it was too late to change lanes without looking suspicious, so we pulled in behind Chuckles and waited. The car in front of Chuckles took maybe two to three minutes to process, and then our favourite Yaris-driving friend pulled into the station.

The car on our right passed through, barely waiting at all. Then another. Then another still. And Chuckles was still being questioned.

After about five minutes of banter, the border agent stepped out of his booth and started looking around Chuckles’ car, obviously telling him to pop the trunk. What happened was what you’d expect: the customs guy finds several shopping bags inside.

Officer Correct Assumption reaches into one of Chuckles’ obvious shopping bags and unveils a receipt that clearly encompasses a good day’s worth of shopping. After slamming the trunk twice – unsuccessfully – he walks around to the front of the vehicle and appears to show Chuckles the bill, continuing the conversation. Apparently Chuckles’ answer doesn’t satisfy him, as he then walks around the back and looks through every bag, pulling receipts from each.

Taking the wad of receipts, the customs agent returns to his shack and begins writing something down. It is at this point that my family decides honesty is perhaps the best policy, and to eat any duty charges rather than having our trunk scrutinized in the same manner.

Chuckles leaves with an official looking yellow piece of paper, but does not stop at secondary processing. It appears that customs just bills people trying to avoid duty fees, in an effort to avoid holding up the line.

As we pull up, we’re asked the standard set of questions. Where are we going, do we have any alcohol or tobacco, how long we’ve been there. The agent is smart: he asks for the total value of goods purchased in the States, not if we have anything to declare. Answering $100 (total, not per person) and indicating some of the items of clothing purchased takes a total of under a minute, without attracting the ire of the customs weasel or any duty paid.

What I later find out is that making a false declaration or not declaring anything isn’t a matter of “oh, you got caught, now pay duty.” It’s much more painful than that – you actually pay a lying penalty:

If you do not declare goods, or if you falsely declare them, we can seize the goods. This means that you may lose the goods permanently or that you may have to pay a penalty to get them back. Depending on the type of goods and the circumstances involved, we may impose a penalty that ranges from 25% to 80% of the value of the seized goods.

In addition, the Customs Act provides border services officers with the authority to seize all vehicles that were used to import goods unlawfully. When this happens, we impose a penalty that you must pay before we return the vehicle.

If you do not declare tobacco products and alcoholic beverages at the time of importation, we will seize them permanently.

A record of infractions is kept in the CBSA computer system. If you have an infraction record, you may have to undergo a more detailed examination on future trips.

The moral? Don’t assume border agents are stupid or will just let you pass with a “nothing to declare” – answer reasonably honestly and things should go fine. Best of luck shopping in the States!